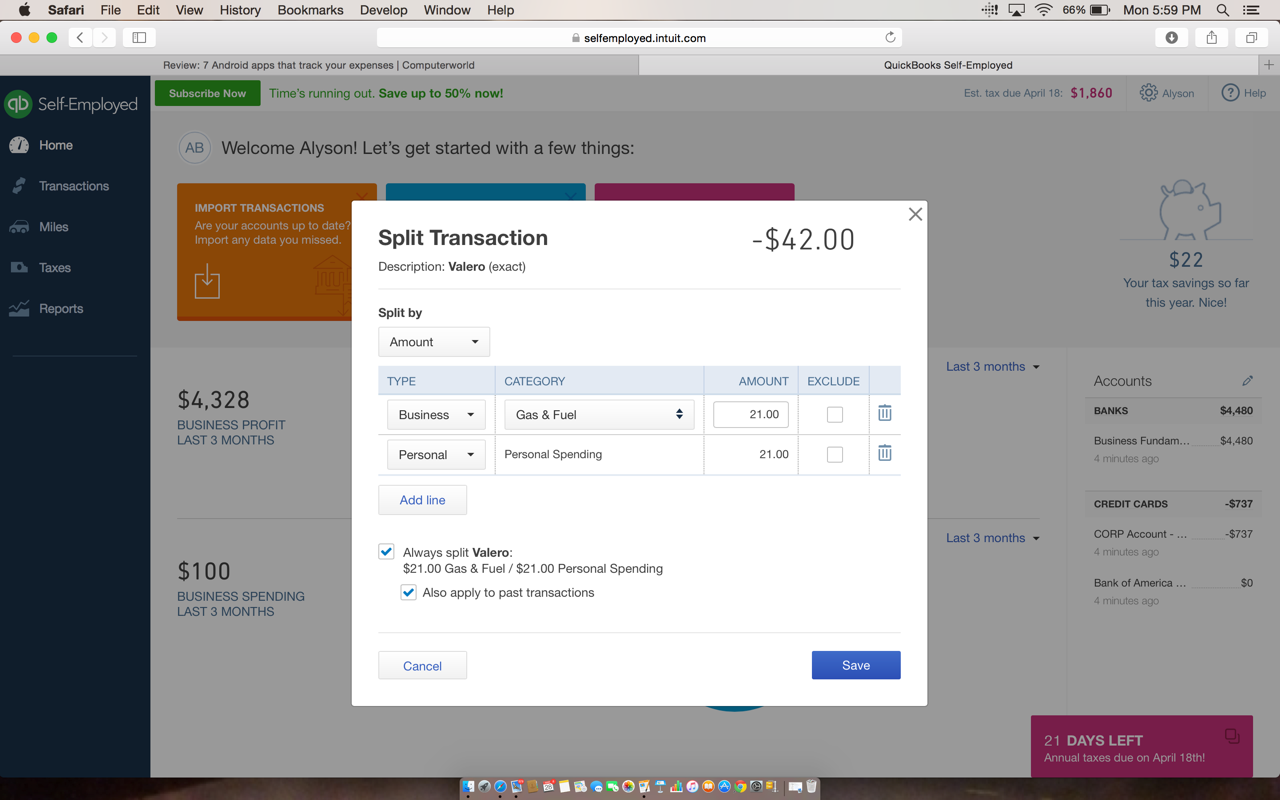

This where Turbo-Tax Self Employed comes in to help you! Anytime you have a question, you can actually talk to a credentialed tax expert who specializes in self-employment taxes. Am I forgetting anything that is tax-deductible?.When it comes down to it, these are usually the two biggest questions I ask myself over and over again: Whether it’s throughout the year or for those of you that do your taxes last minute, TurboTax Self-Employed can help with this. Once you start using Quickbooks Self-Employed, you might have questions with your taxes. How TurboTax Self-Employed helps if you have questions This is so much easier than writing everything down in a notebook and then adding the miles up with a calculator. The app will then track my total miles as well as let me know my tax deduction. With the app, I just click on the ‘Mileage’ button at the bottom of the app and can start tracking my miles. I also love to go to blogger and business meet-ups around town, grab supplies at Target and have pow-wow sessions with other businesses, so it’s hard for me to keep track of all my driving. If you follow me on Instagram, many of you know that I am always working at coffee shops around town. Depending on how you file your taxes – quarterly or annually – you’ll be able switch between the two tabs and see how much you owe!Īnother feature that is really helpful with Quickbooks Self-Employed app is the ability to track my mileage. If you want to look at your taxes, you just click on the ‘tax’ tab in the menu. It’s really interactive and easy to use! You can quickly view your profit and loss, milage, invoices and more. If you prefer to use your cell phone, the Quickbooks Self-Employed app works really well.

#QUICKBOOKS SELF EMPLOYED BUDGET PLUS#

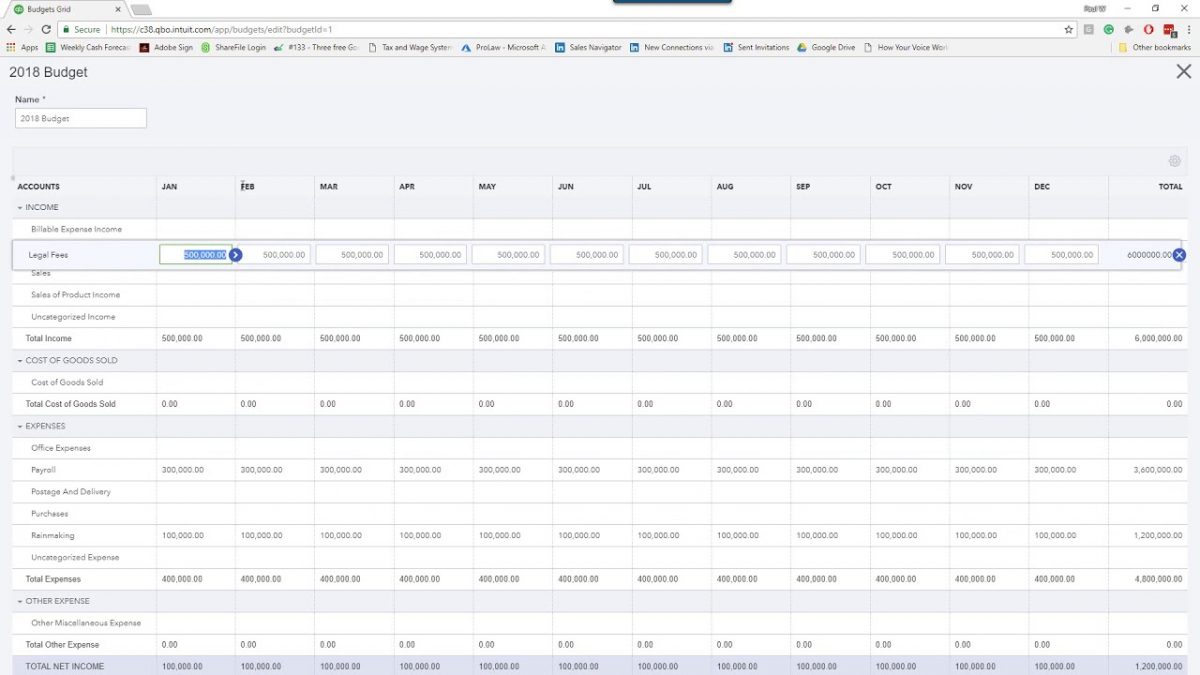

I really like how easy it is to read a lot of information – you’ll be able to see your profit and loss, your expenses and your tax savings all on the dashboard! Plus there are tabs on the left side of the screen, so you can just click on each tab to focus on a specific area. The dashboard is really easy to use and understand. It literally takes seconds! Once that is complete, you will be able to view your dashboard. Once you have signed up with Quickbooks Self-Employed, you just connect your bank information. By using Quickbooks Self-Employed year round, everything will integrate over into TurboTax Self-Employed when it’s time to pay your taxes. It’s hard enough being self-employed and getting all my work done having QuickBooks Self-Employed has definitely helped cut down on my stress! How TurboTax Self-Employed and QuickBooks Self-Employed work togetherĪs I mentioned above, both programs are fully compatible. It’s such a relief to log in to QuickBooks Self-Employed and see that all my business information is in order so I can get back to focusing on my blog and business.

9 Ways to Avoid Blogging and Freelance Burnout.

Here’s a few reasons why I really like the partnership: This is a really unique partnership because it’s the only combined tool that helps prep your taxes year round for people like me that are self-employed! Since I use TurboTax Self-Employed to file my taxes every year, it makes sense to use their companion tool called QuickBooks Self-Employed. Seriously, the amount of time it takes to get a year’s worth of bills, receipts, invoices and more finished in a short amount of time when facing the tax deadline is just too much to handle! I decided that if I can plan out and schedule what I want to accomplish with my blog and business year round, there’s no reason I can’t do that with the financial side of my blog and business as well. My number one business goal this year is to stay organized! While I like to plan out my blog and business schedule per quarter, I realized I didn’t have a plan for my work finances. After another year of putting off my taxes until last minute (raise your hand if you’re with me) I realized I can’t handle the stress.

0 kommentar(er)

0 kommentar(er)